Accounts Receivables & Denial Management

Use our Expertise to Track your Receivables with Ease

30 days is the ideal time for a claim to get processed. Anything that takes longer than this should be properly analyzed to understand the delay and fix it so that you don’t leave any money on the table. Accounts Receivables is a key indicator of your practice’s financial health and plays a major role in reducing the DSO which is a measure of the average number of days that it takes a company to collect payment for a rendered service.

Identify Payment Delays and trends

Strategies for better workflow

Reduced Days Sales Outstanding

Fewer Claims Resubmissions

Track Claim Status

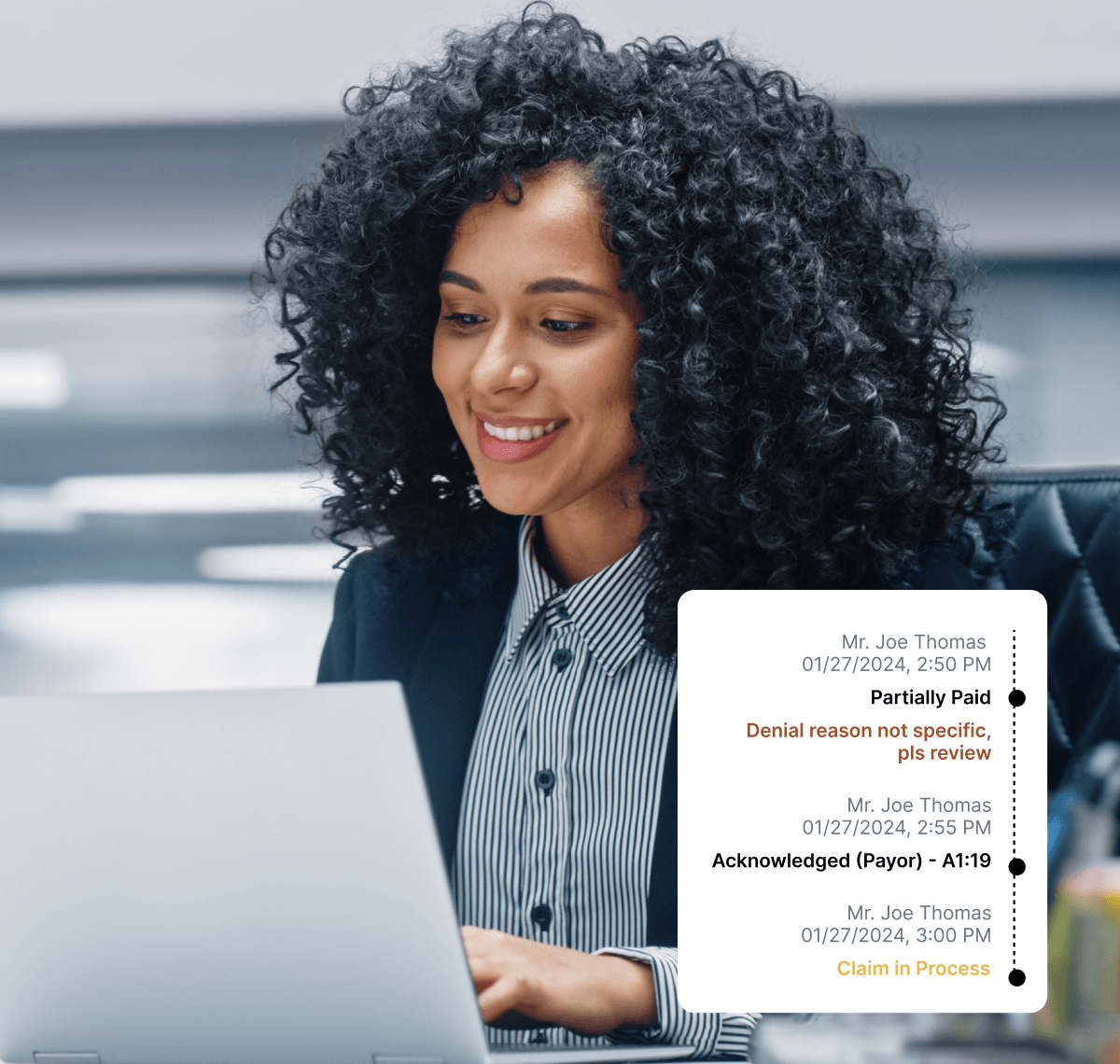

Payment information is duly updated after thorough verification via calls and websites to get the latest status of the claim.

Make Claim Adjustments

After thorough investigation is done, denied or partially paid claims are adjudicated for a balanced ledger.

Reprocess Claims

Resubmissions and appeals are made whenever a payor needs additional documentation to get complete payments.

Listen To What Our Customers Say About Us

Rahseeda Johnson

Owner, DentCare Now

When they come in, our focus is solely on that patient.

"So what's the treatment that you need? When we're presenting the treatment plan now, we can present it with confidence and we can do a lot of same day treatment, which helps get the patient out of discomfort or get their needs met. So I would say their experience is better."

Features

Experience denial free claims and maximize your collection.

Follow-up done every 30 days & Consequent follow up

Learn the status of every claim submitted within the last 30 days. Know which claims are paid, pending or denied.

Rejections

Resolve issues such as incorrect subscriber or policy details, invalid fee or procedure code, incorrect payor id etc, that results in rejection.

Denials

Non-payment causes are identified. Where possible, claims are reprocessed with additional information, to resolve the denials.

Partially Paid

Understand the reason for incomplete payments. Reprocess or appeal with additional information wherever possible for the pending balance.

Resubmissions

Refile claims that need additional information like Xrays, W9 forms, narratives, etc. Fast resubmissions ensure that no time is lost.

Appeals

Appeals are submitted with a detailed narrative and supporting clinical documents to be reconsidered for payment.

Claims Adjudication

After all the information is gathered from the payor, necessary adjustments are made like closing a claim, write-offs, transfer balance to patient etc.

Interactive Claim Flags

Easy-to-understand claim flags that fit every situation, whether it is to notify about a payment update or to give proper instructions about the next action.